vanguard tax-exempt bond etf fact sheet

This ETF offers exposure to short term government bonds focusing on Treasury bonds that mature in one to three years. The management fee is equal to the fee paid by the Vanguard fund to Vanguard Investments Canada Inc and does not include applicable taxes or other fees and expenses of the Vanguard.

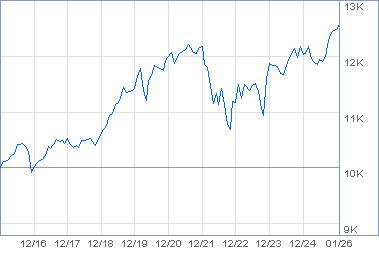

Vteb Share Price And News Vanguard Tax Exempt Bond Index Fund Nyse

This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end.

. Learn everything about Vanguard Tax-Exempt Bond ETF VTEB. Red areas below the Last Price will tend to provide resistance to confirm the downward move. 2 years on fund 15 years of experience.

Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. VTEB Tax-Exempt Bond ETF Summary prospectus Fact sheet Compare product MARKET PRICE 5035 as of 08192022 MARKET PRICE CHANGE -018 -037 as of. This popular ETF offers exposure to the long end of the maturity curve with exposure to all types of bonds that have maturities greater than 10 years.

U - Unity Software Inc V - Visa Inc. Value1 3 times K Stochastic - 2 times Raw Stochastic Value2 14-Day. Brokerage assets are held by Vanguard Brokerage Services a division.

A non-money market funds SEC yield is based on a formula mandated by the Securities and Exchange Commission SEC that calculates a funds hypothetical annualized income as a. And BS East Stroudsburg. Free ratings analyses holdings benchmarks quotes and news.

Fact sheet June 30 2022. Vanguard Tax-Exempt Bond Index Fund. Vanguard Massachusetts Tax-Exempt Fund seeks current income by investing at least 80 of its assets in securities exempt from federal and Massachusetts.

Tax risk which is the chance that all or a portion of the tax-exempt income from municipal bonds held by the Fund will be declared taxable possibly with retroactive effect because of. BLV is heavy on both. Tax risk which is the chance that all or a portion of the tax-exempt income from municipal bonds held by the Fund will be declared taxable possibly with retroactive effect because of.

The links in the table below will guide you to various analytical resources for the relevant ETF. As such interest rate exposure for this product will be. McFee CFA Portfolio manager.

Get detailed information on Vanguard Tax-Exempt Bond Index Fund ETF Shares including fund information fund performance and ETF calculator on this ETF Factsheet. The group has advised Vanguard Tax-Exempt Bond ETF since 2015.

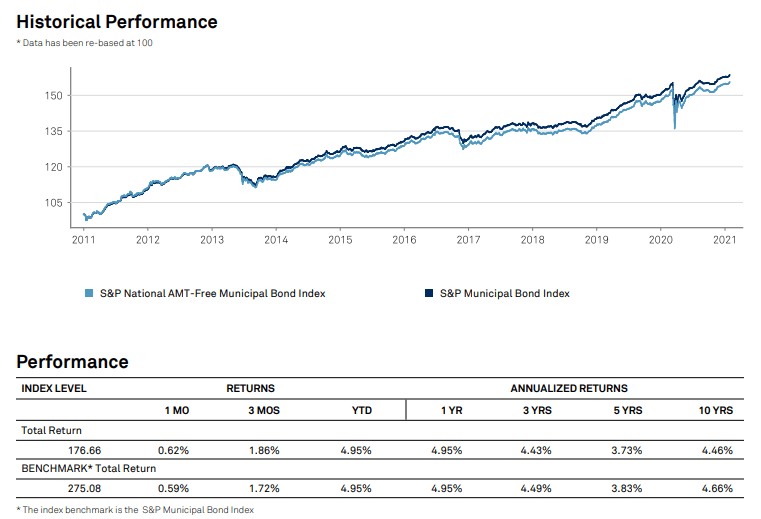

Vanguard S New Venture Indexing Muni Bonds Morningstar

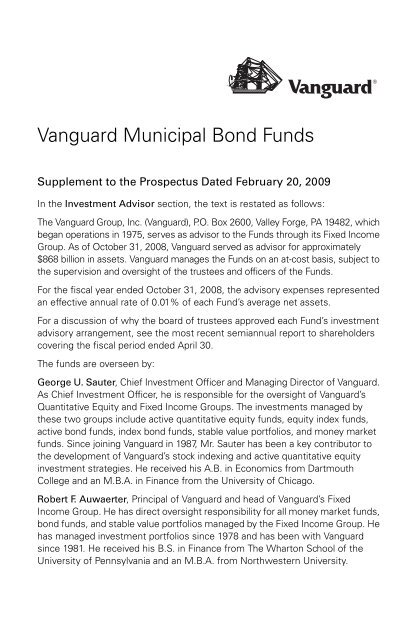

Vanguard Municipal Bond Funds Prospectus Investor Shares

Municipal Bonds Are The Apple Of Fixed Income Investors Eyes

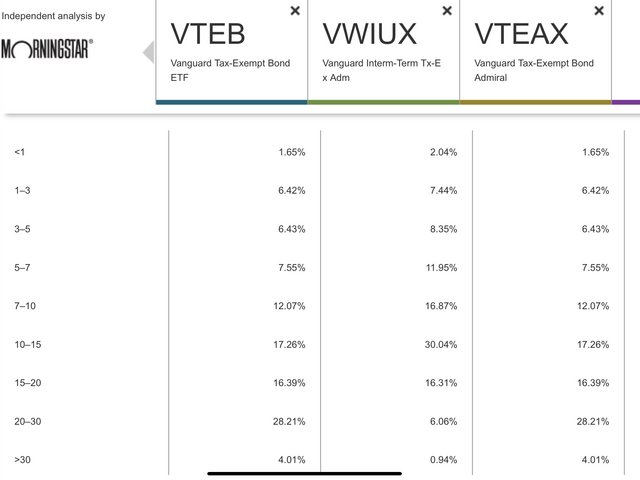

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Muni Etfs Grow Fast As Yield Starved Investors Seek Cheap Funds Bloomberg

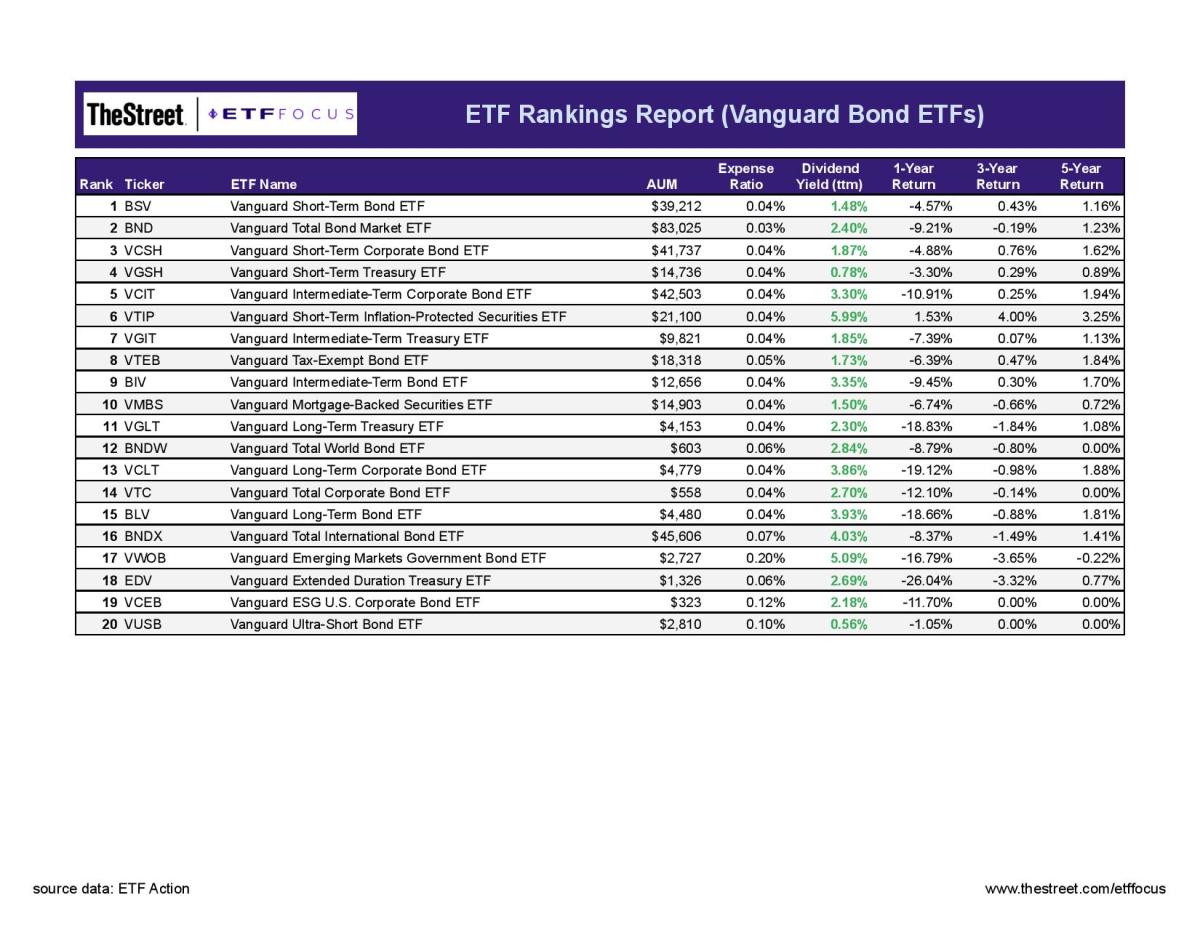

Best Vanguard Bond Etfs Updated August 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

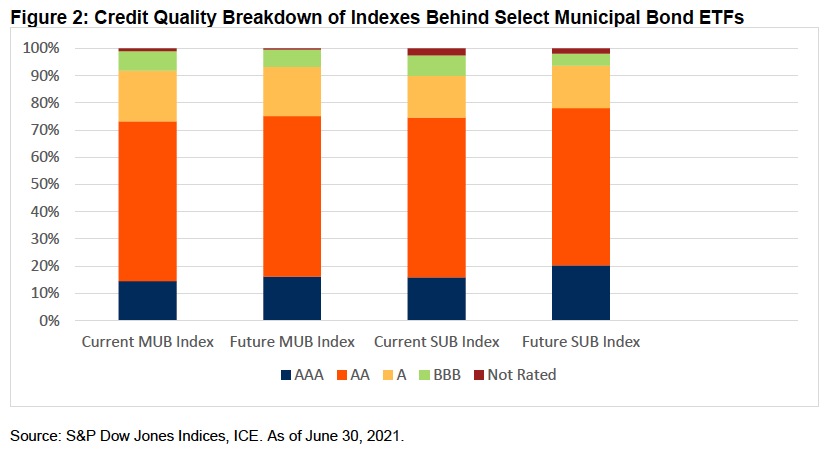

Easier Muni Indexing Expands Investors Choices Morningstar

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Etf Channel

2019 Etf Returns Were Very Strong For Both Equity And Fixed Income

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vanguard Municipal Bond Funds Prospectus Investor Shares

Second Half Tailwinds For Municipal Bond Etfs

How Much Can Tax Managed Model Portfolios Save On Taxes Morningstar

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

The Best Performing Bond Etfs How To Find Them Nasdaq